The UAE’s real estate market has always been a magnet for global investors seeking stability, luxury, and strong returns. Yet in recent years, one trend has reshaped the investment landscape: flexible developer payment plans.

Instead of the long, complex process of applying for bank mortgages, more investors are choosing developer-backed schemes that offer simplicity, lower upfront costs, and customizable payment timelines.

At OPlus Realty, we’ve seen this shift firsthand across Dubai and Abu Dhabi, where investors are increasingly drawn to projects that allow them to invest smartly—without compromising liquidity or flexibility.

The Evolution of Property Financing in the UAE

For years, traditional mortgages dominated the market. Buyers had to navigate lengthy approval processes, strict eligibility checks, and high down payments. But as the UAE’s property landscape evolved, so did investor expectations.

Modern investors now prioritize flexibility, speed, and control, especially those purchasing off-plan properties—and developers responded accordingly.

Flexible payment plans emerged as the perfect solution, allowing investors to spread payments over several years and sometimes even after handover. These plans are designed to make real estate investment more accessible while still supporting long-term financial planning.

How Flexible Payment Plans Work

Flexible payment plans in the UAE are developer-led financing options that spread property payments across construction and post-handover periods. Rather than borrowing from a bank, investors pay the developer directly through structured installments.

Common Features:

- Lower upfront payments: Usually much smaller than the 20–25% mortgage down payment.

- Milestone-linked installments: Payments are tied to construction progress, giving transparency and predictability.

- Post-handover payment options: Buyers can occupy or rent the property while continuing to pay.

- No interest or bank approval needed: Reducing bureaucracy and financial stress.

This straightforward approach opens the door for a broader range of investors—from first-time buyers to seasoned real estate portfolio holders.

Why Traditional Mortgages Are Losing Appeal

While mortgages still serve a purpose, they can be less appealing to investors seeking flexibility. The reasons are clear:

- High down payments: Banks often require significant upfront investment.

- Fluctuating interest rates: Payments can increase with economic changes.

- Lengthy approval process: Bank paperwork can delay opportunities.

- Limited eligibility: International investors often face stricter criteria.

For overseas buyers or entrepreneurs with multiple investments, these restrictions can make mortgages feel outdated compared to developer-led payment solutions.

Top Advantages of Flexible Payment Plans for Investors

1. Lower Entry Barriers

One of the most attractive aspects is affordability. Investors can enter the market with smaller upfront costs, freeing up capital for other investments or lifestyle needs.

2. Predictable and Transparent Costs

Unlike mortgages with changing interest rates, flexible plans typically have fixed payments. This predictability allows investors to plan their cash flow with confidence.

3. Portfolio Diversification

With lower initial commitments, investors can diversify—buying multiple properties across Dubai and Abu Dhabi rather than focusing on one high-value mortgage.

4. Perfect for Off-Plan Properties

Most developers align payment schedules with project milestones. This structure means you only pay as construction advances, minimizing risk and aligning payments with tangible progress.

Want to know the best real estate options in the UAE? Contact us today to inquire!

Contact us via WhatsApp

Abu Dhabi vs. Dubai: How Payment Plans Shape Demand

Both emirates have embraced flexible payment plans, though their markets appeal to different investor motivations.

Abu Dhabi: Lifestyle and Long-Term Security

Areas such as Saadiyat Island, Yas Island, and Al Reem Island attract investors focused on lifestyle, culture, and long-term growth. Payment plans here appeal to end-users and families who prefer gradual, manageable investment options.

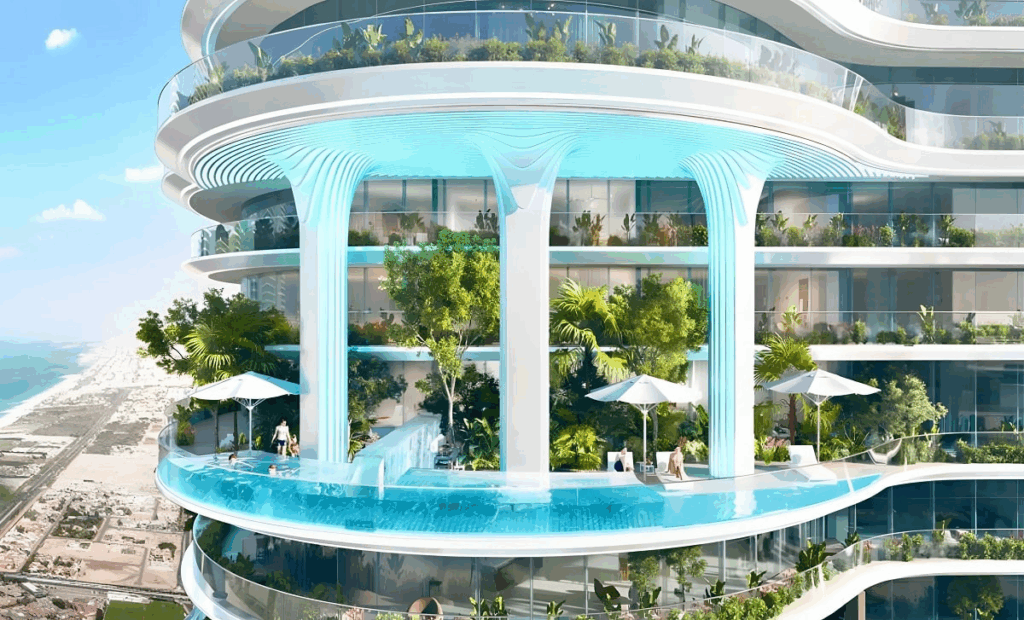

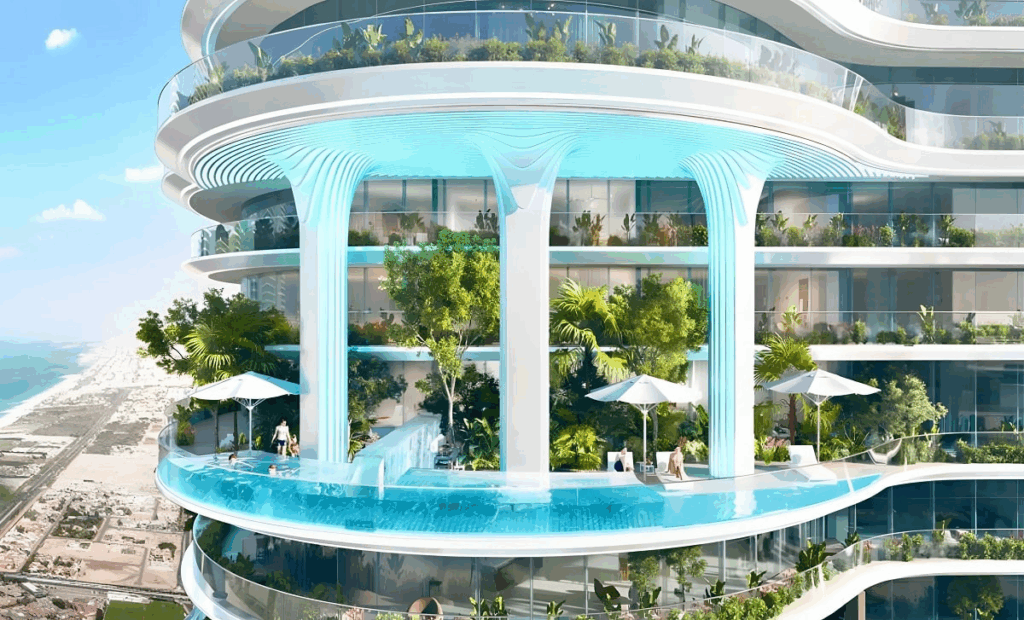

Dubai: Global Appeal and High Returns

In contrast, Dubai’s real estate scene thrives on its international investor base. Payment plans are particularly popular in areas like Downtown Dubai, Business Bay, and Palm Jumeirah, where developers compete to offer the most flexible structures for high-yield properties.

The Broader Impact on the UAE Real Estate Market

The widespread adoption of flexible payment plans has transformed market dynamics in several key ways:

- Boosting off-plan sales: Developers use these schemes to attract both local and global buyers.

- Encouraging sustainable investment: Investors can commit confidently to long-term projects.

- Reducing market volatility: Broader access to property ownership stabilizes demand.

- Supporting economic growth: More real estate transactions mean more development, jobs, and capital flow.

Developers are now competing not only on project quality but also on the payment flexibility they offer—a healthy sign for investors seeking choice and innovation.

What This Trend Means for Investors in 2025

As we move through 2025, flexible payment plans have become the new normal in UAE property investment. The trend aligns perfectly with global shifts toward personalized financial planning and digitalized real estate transactions.

Investors today are more strategic—they seek financial models that align with cash flow, risk tolerance, and long-term objectives. For many, buying property through developer payment plans isn’t just easier—it’s smarter.

At OPlus Realty, we anticipate even greater adoption of these models as developers continue innovating with zero-down-payment options, extended post-handover schedules, and interest-free installment schemes.

Tips for Investors Considering Flexible Payment Plans

If you’re evaluating flexible payment options, keep these points in mind:

- Check the developer’s reputation – Work only with trusted and RERA-registered companies.

- Understand the payment schedule – Ensure the installments align with construction milestones.

- Review post-handover terms – Know exactly how long payments extend after handover.

- Assess your exit strategy – Flexible plans are great for resale or rental investments if structured correctly.

- Work with a professional brokerage – A knowledgeable partner like OPlus Realty can help you compare offers, negotiate better terms, and minimize risk.

Invest in UAE Real Estate with OPlus Realty

Flexible payment plans have redefined how investors approach real estate in the UAE—offering financial freedom, lower barriers, and faster ownership. Whether you’re targeting a luxury apartment in Dubai Marina or a family villa in Saadiyat Island, these plans can make premium living attainable without heavy financial strain.

At OPlus Realty, our team specializes in helping investors navigate the UAE’s evolving property market. We connect you to developer-backed payment plans that match your budget, lifestyle, and long-term investment goals.

Explore flexible payment opportunities today with OPlus Realty—where smart financing meets exceptional real estate.