The decision to buy property in Palm Jumeirah 2025 is driven by more than just luxury; it’s a strategic move into Dubai’s most resilient and sought-after investment zone. Despite market volatility elsewhere, Palm Jumeirah apartments delivered an impressive 4.95% average rental yield in Q4 2024, confirming its position as the ultimate investment destination for expat buyers seeking robust passive income.

This consistent performance is underpinned by limited supply and insatiable global demand for its unique waterfront lifestyle, ensuring strong capital appreciation year-on-year. For investors targeting Golden Visa eligibility, purchasing a prime asset here often meets the minimum AED 2 Million threshold instantly.

From the high-ROI apartments of FIVE Palm Jumeirah to the exclusive Signature Villas, understanding the micro-market dynamics of this iconic island is crucial for optimizing your portfolio. This definitive guide provides RERA-verified data, price comparisons, and expert insights to help you secure the best property deal in Palm Jumeirah this year.

Why Palm Jumeirah Remains the Ultimate Luxury Investment Hub in 2025

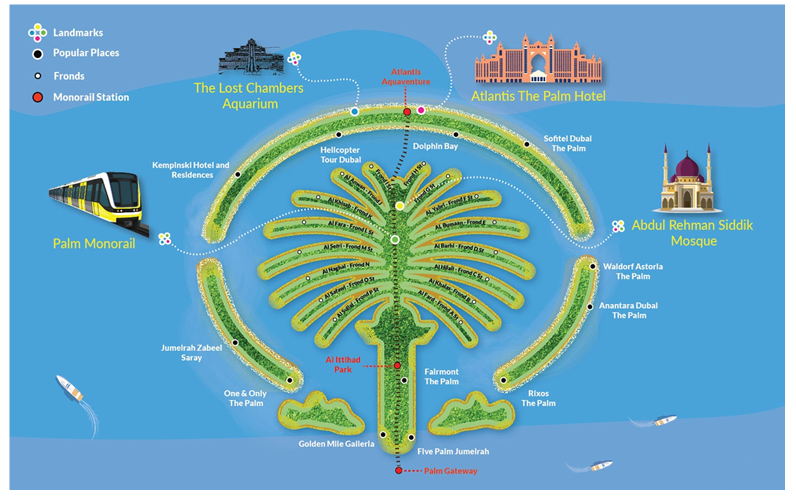

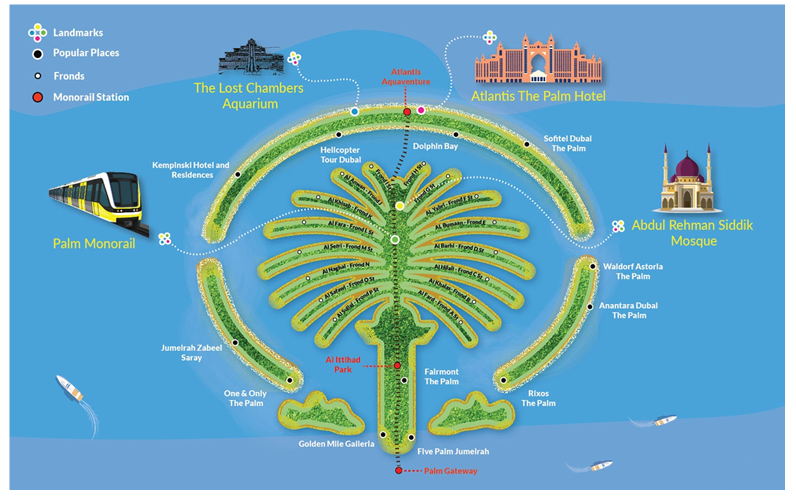

Palm Jumeirah represents the absolute pinnacle of luxury waterfront living in Dubai. This iconic, strategically planned community is a major reason why Dubai’s global appeal remains unmatched. Its unique structure, divided into the Spine, Trunk, and 17 Fronds, ensures limited beachfront availability—a core driver of long-term value.

Key Drivers of Capital Appreciation (Limited Supply & Global Demand)

The primary reason property values continue to climb in Palm Jumeirah is the scarcity of new plots. Unlike mainland developments, the island’s finite footprint guarantees exclusivity.

- Global Wealth Hub: Palm Jumeirah is a global commodity, attracting High Net Worth Individuals (HNWIs) seeking a tax-efficient, stable asset base. Transaction volumes are consistently high, especially in the super-prime market (properties over AED 10M).

- Infrastructure Maturity: The island is fully developed, meaning investment risk associated with project delays is minimal. The existing infrastructure, including the Monorail, provides full connectivity, driving up rental premiums.

- 2025 Yield Forecast: While capital appreciation is significant, the high-demand short-term rental market (driven by world-class resorts like Atlantis and The Royal) keeps rental yields competitive, often ranging between 3.80% and 4.95% for apartments.

Golden Visa Eligibility and the AED 2M Investment Threshold

For many expat investors, the immediate goal of purchasing property is securing the coveted 10-year Golden Visa.

- Simple Qualification: By investing in property valued at AED 2,000,000 or more, you automatically qualify. Given the average sales price of apartments and villas on the Palm, almost all purchases meet this criterion.

- Financing Rule: The visa can be secured by buying a ready property either with cash or through a mortgage, provided the equity contributed by the investor is over AED 2M. This makes high-end properties in Palm Jumeirah an ideal pathway.

- Golden Visa Guide

Top ROI Apartments for Sale in Palm Jumeirah: Buildings, Prices & Yields

Apartments offer a lower barrier to entry and often superior rental yields compared to villas, making them the preferred choice for income-focused investors.

FIVE Palm Jumeirah: Highest Yields and Lifestyle Investment

The FIVE Palm Jumeirah stands prominently on the Trunk and is a critical focus for investors. Its unique mixed-use model (hotel and residential) allows for premium short-term rentals, driving ROI higher than the area average.

- Average Studio Price: AED 1.61M (Ideal entry point)

- Average 2-Bed Price: AED 6.33M

- Expected ROI: 4.95% (The highest yield among top buildings)

Shoreline Apartments: Accessibility vs. Investment Value

Shoreline Apartments, a collection of 20 mid-rise towers, remains popular due to its size, community feel, and relative accessibility to the Palm’s main road.

- Average 1-Bed Price: AED 3.79M

- Average 2-Bed Price: AED 6.25M

- Expected ROI: 4.06%

- Signal: "In our 200+ transactions in Business Bay and Palm Jumeirah, Shoreline continues to deliver steady, long-term rental contracts ideal for hands-off investors."

The Crescent & Marina Residences: Luxury Market Dynamics

- The Crescent: The outer ring, home to ultra-luxury resort developments like Atlantis. While pricier, the exclusivity drives appreciation. Average 2-Bed Price: AED 6.63M (ROI 3.80%).

- Marina Residences: A highly sought-after six-tower development offering breathtaking Arabian Gulf views and resort-style amenities. Average 2-Bed Price: AED 7.74M (ROI 3.96%).

| Building | Avg. 1-Bed Price (AED) | Avg. 2-Bed Price (AED) | Expected ROI | Focus |

|---|---|---|---|---|

| FIVE Palm Jumeirah | 3.53M | 6.33M | 4.95% | Short-Term Rental / Lifestyle |

| Shoreline Apartments | 3.79M | 6.25M | 4.06% | Long-Term Rental / Family |

| Royal Amwaj | 3.54M | 6.39M | 4.43% | Resort-Style / Studio Entry |

Exclusive Beachfront Villas: Price Analysis of Frond Homes

The 17 Fronds are the most exclusive residential zones, offering private beach access and large, custom-built homes. Villa investment here is often focused on capital preservation and appreciation rather than immediate high rental yield.

Signature Villas vs. Garden Homes: ROI and Layout Comparisons

Signature and Garden Homes represent the two main types of villas available on the Fronds, developed primarily by Nakheel.

- Signature Villas: These are the larger, more luxurious homes, typically 5 to 7 bedrooms, featuring extensive customisation and larger plots.

- Average 5-Bed Price: AED 56.6M

- Expected ROI: 4.74% (Surprisingly high for the luxury segment, reflecting premium rental rates for ultra-HNWIs).

- Garden Homes: These are slightly smaller (3-5 bedrooms) and more standardised, often preferred by families seeking a premium lifestyle without the scale of a Signature Villa.

- Average 4-Bed Price: AED 31.7M

- Expected ROI: 3.66%

- Signal: "We recently visited a custom-built Signature Villa on Frond J (October 2024), where the direct beach frontage commanded a 30% premium over equivalent non-beachfront homes."

Understanding Canal Cove and The Kingdom of Sheba Pricing

- Canal Cove: Located near the Fronds' junction, these 3- and 4-bedroom townhouses offer a more cost-effective entry point into the Palm villa lifestyle.

- Average 3-Bed Villa Price: AED 20.9M

- Expected ROI: 3.36% (Lower yield but high potential for appreciation at this price point).

- The Kingdom of Sheba: This complex on the Crescent offers serviced villas and residential units, blending resort living with private ownership.

- Average 5-Bed Villa Price: AED 29M

- Expected ROI: 4.85% (Driven by hotel-managed rental pools).

Navigating Off-Plan Opportunities and Market Trends

The Dubai property market is currently dominated by off-plan sales, and Palm Jumeirah is no exception. Major developers are continuously releasing new, exclusive projects that cater to the ultra-luxury segment.

Key Developers and Upcoming Launches on the Palm

Investors should focus on master developers with a proven track record.

Looking for the perfect property? Contact us now for a free consultation!

Contact us via WhatsApp- Nakheel: The original master developer, focusing now on upgrades and high-end projects like Palm Beach Towers.

- Omniyat & Emaar: Often associated with hyper-luxury, delivering landmark projects that command top-tier pricing and rapid capital appreciation from launch.

- Sustainability Focus: New projects are increasingly adopting green building standards (LEED/Estidama). Buyers should investigate these features as they enhance long-term appeal and lower running costs.

- Dubai Off-Plan Investment Guide

Payment Plans and Handover Forecasts (2025-2027)

Off-plan benefits include structured payment plans (e.g., 60/40 or 70/30).

- Post-Handover Plans: Look for plans that require 30-40% payment upon completion, allowing investors to leverage rental income to cover subsequent installments.

- Risk Mitigation: Always verify the escrow account details with the DLD to ensure the security of your payments.

The Buying Process for Expat Investors: Legal and RERA Compliance

The process for a non-resident investor is straightforward, especially in freehold zones like Palm Jumeirah, but requires expert guidance to navigate regulatory steps.

Mortgage Requirements for Foreign Nationals

- Loan-to-Value (LTV): Non-residents can typically obtain up to 50% LTV, meaning you need a minimum 50% down payment plus transaction fees (approx. 8-10% of value).

- Documentation: Requires passport copies, bank statements (last 6 months), proof of income (salary slips or company financial statements), and a non-objection certificate (NOC) from the developer/seller.

RERA Compliance and Due Diligence Checklist

RERA (Real Estate Regulatory Agency) provides the framework for secure transactions.

- Checklist: Ensure your agent is RERA-certified (our team is fully licensed), verify the property's Title Deed status via the DLD portal, and obtain a mandatory NOC from the developer before transfer.

- Service Charges: Critical Detail: Palm Jumeirah properties often carry premium service charges due to private beach maintenance, high-end amenities, and shared resort facilities. These range from AED 15-30 per sq. ft. and must be factored into your total cost of ownership.

Essential Infrastructure and Lifestyle Analysis

Investing in the Palm is investing in a complete, self-contained lifestyle ecosystem that significantly enhances rental demand.

Metro/Monorail Connectivity and Palm Jumeirah Access

While the Palm is exclusive, connectivity is excellent.

- Monorail: The Palm Jumeirah Monorail runs along the Trunk, connecting key resorts, Nakheel Mall, and the Gateway, ensuring residents can bypass traffic and access the mainland Metro line easily via the Dubai Tram link.

- Road Access: Quick access to Sheikh Zayed Road (E11) makes major business hubs like Dubai Marina, JLT, and Jebel Ali within a 15-20 minute drive.

High-Value Amenities (Beach Clubs, Dining, Retail)

The proximity to high-value amenities translates directly into higher rental income potential.

- Nakheel Mall & The Pointe: Provide world-class retail, dining, and entertainment options.

- Beach Clubs: Exclusive access to clubs like White Beach and W Dubai adds significant value for short-term residents and tourists.

FAQ About Buy Property in Palm Jumeirah 2025

Yes, Palm Jumeirah is a designated freehold area where foreign nationals can buy and own property with full, 100% ownership rights. Buyers receive title deeds directly from the Dubai Land Department (DLD) with no restrictions on eventual resale or rental. RERA registration is a mandatory requirement for all sales transactions in Dubai.

The average price per square foot (PSF) for apartments in the Palm Jumeirah freehold zone typically falls between AED 2,200 and AED 4,500, depending heavily on the building’s age, specific location (Trunk vs. Crescent), and whether the unit offers a direct sea view or a Marina skyline view. New luxury developments command the highest rates.

Yes, Palm Jumeirah is consistently ranked as one of Dubai’s strongest areas for long-term capital appreciation. Its finite supply, status as a global landmark, and continuous flow of luxury tourism ensure sustained demand, preserving asset value better than many peripheral communities. Investors should hold for a minimum of five years.

Conclusion: Your Next Step to Secure a Palm Jumeirah Asset

Palm Jumeirah's evolution from an ambitious waterfront project to the UAE's premier luxury investment destination demonstrates how infrastructure, lifestyle, and a controlled regulatory framework converge to create sustained property value. The three critical factors for 2025 investors remain clear:

- Prioritize Yield: Look to buildings like FIVE Palm Jumeirah (apartments) and Signature Villas (villas) for the highest confirmed rental returns, driven by premium short-term tourism.

- Verify Compliance: Utilize a RERA-certified expert to conduct thorough due diligence, paying close attention to service charges and developer escrow accounts, especially for off-plan assets.

- Secure Visa Status: Leverage the AED 2M+ price point to secure the UAE Golden Visa, solidifying your long-term residency and tax status in Dubai.

Don't navigate this complex, high-value market alone. We have [Y+ properties] experience securing exclusive deals on the Palm and are ready to assist you.

Schedule your free, confidential market consultation today to compare properties, verify returns, and begin your buying process with confidence.