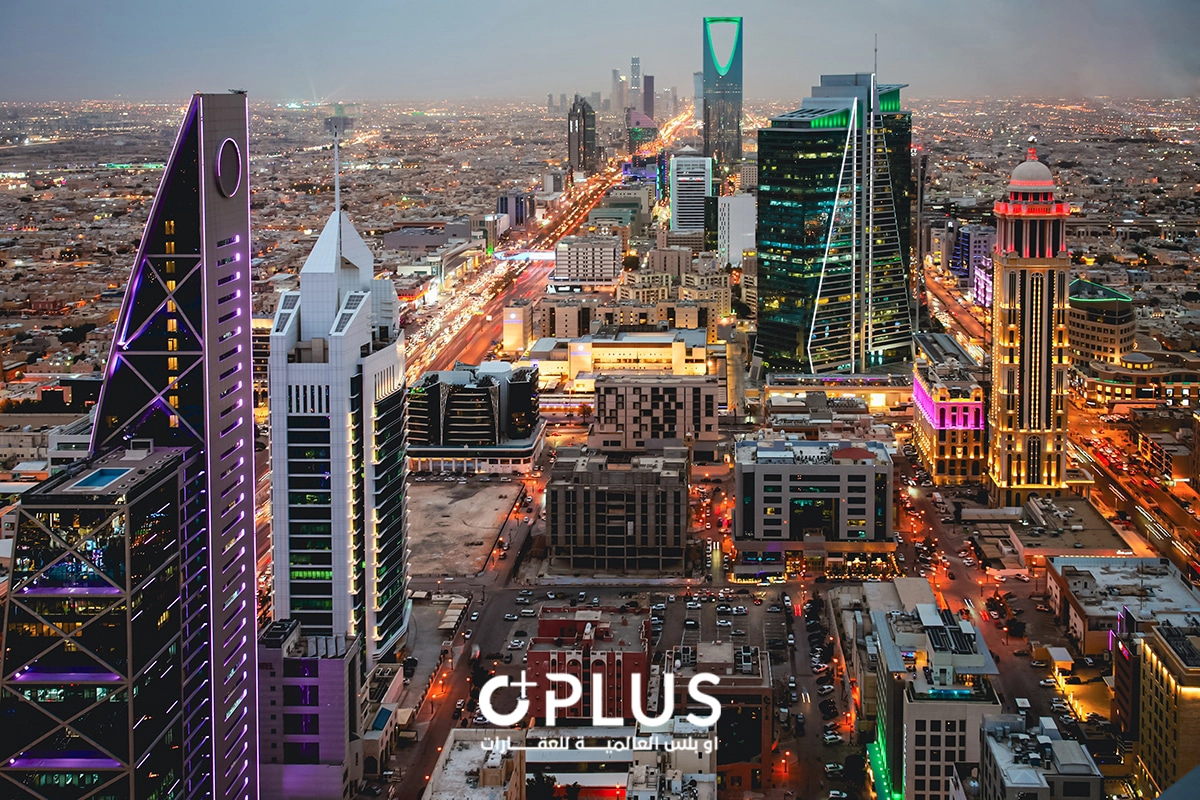

Riyadh Real Estate 2025: Is Saudi’s Capital Becoming a Super Hub?

The Riyadh real estate 2025 outlook paints a picture of transformation. Thanks to ambitious infrastructure projects, booming demand for offices, and rising global investment, Riyadh is effectively positioning itself as the “super hub of the future.” Consultants such as Knight Frank highlight Saudi Arabia’s aggressive pivot away from oil dependency toward sectors like finance, culture, tourism, and real estate.

At OPlus Realty, we’re closely following this transition—and it’s clear Riyadh is emerging as a real estate powerhouse, built for long-term growth and global relevance.

Why Riyadh Is Positioned to Become a Regional Super Hub

Knight Frank recently noted:

“The Saudi capital is rapidly transforming into a dynamic destination for global wealth… strategically diversifying its economy away from oil dependence and evolving into a powerhouse for finance, culture and lifestyle.”

A combination of massive urban development, investment-friendly policy, and economic diversification places Riyadh on the map for global businesses and high-net-worth individuals intent on capitalizing on the city’s trajectory.

Lowering Saudi Unemployment—and Lifting Real Estate Demand

The push for economic diversification is yielding results. Saudi unemployment dropped to a record low of 7% in Q4 2024, empowering more people with disposable income—and more housing and office space demand.

Additionally, the issuance of over 160,000 new business licenses in Q4 2024 (a 67% rise) raised the total number of registered enterprises to 1.6 million—driving demand for both commercial and residential real estate.

A Surge in Grade-A Office Demand and Development

Rock-Bottom Vacancy, Sky-High Rents

Riyadh’s push to become a regional office hub is reflected in its Grade-A office vacancy rate of just 2%. Meanwhile, prime office rents have seen considerable growth—23% over the past year, and an impressive 84% since Q1 2020. This tight market is driven by:

- Inflow of regional HQs

- Government-backed infrastructure

- Institutional investment targeting high-quality office stock

Regional Headquarters Programme Exceeds Expectations

The Regional Headquarters Programme, which promised to attract international firms, has exceeded its 2030 goals already—with around 600 global companies opening offices in Riyadh. Notable signatories include Bechtel, Northern Trust, and PwC—all of which chose Riyadh as their regional base.

As a result, the city’s office stock is projected to nearly double—from 5.5 million sqm to 9.8 million sqm by 2027. State-driven investment in transport and utilities is supporting this scale-up, while institutions continue to target long-term returns on commercial assets.

How This Office Boom Impacts the Housing Market

With a surge in commercial activity, providers of high-end housing are racing to meet demand. Many professionals relocating to Riyadh are eyeing modern apartments and mixed-use districts.

Prominent developments include:

- Smart, integrated communities offering live-work-play experiences

- Transit-oriented housing near metro lines

- Luxury towers with full amenities and international standards

Infrastructure as the Backbone of Real Estate Growth

Riyadh’s transformation isn’t limited to towers—it includes massive infrastructure initiatives:

- A metro network connecting key business corridors

- Expansion of roads and highways to ease congestion

- Development of new transit hubs and smart city tech

These upgrades make access to offices and residences smoother, increasing land and real estate values along the transit network.

Retail, Leisure, and Cultural Growth

Even as Riyadh builds tower after tower, it’s also investing heavily in lifestyle assets. We’re seeing:

- Large-scale shopping malls and entertainment zones

- Cultural attractions tied to Saudi Vision 2030

- Family-friendly township models with parks, schools, and leisure spaces

This broad vision ensures that work and play thrive together, boosting both property values and tenant demand.

What Real Estate Investors Need to Know

1. Office Investments

- Low vacancy and high demand suggest rental growth potential

- Look for properties in metro-linked districts

2. Residential Developments

- Focus on integrated communities with strong traffic and amenity access

- Demand rising for premium apartments and full-service towers

3. Mixed-Use and Retail Hubs

- The convergence of work, shopping, and entertainment creates long-term asset value

- Think long term—Saudi funding and policy commitment ensure results

Riyadh Real Estate 2025 vs Dubai & Abu Dhabi

While Dubai and Abu Dhabi remain Middle East investment hubs, Riyadh offers unique advantages:

| Feature | Riyadh (2025) | Dubai / Abu Dhabi |

|---|---|---|

| Office vacancy | ~2% (very low) | 10–15% (stable) |

| Lease cost growth | +23% YoY, +84% since 2020 | ~5–10% YoY |

| Infrastructure tailwinds | Metro, smart cities, transit hubs | Mature transport infrastructure |

| Global HQ programs | 600+ companies, fast-growing | Emerging program |

| Residential expansion | Rapid supply with metro connections | Ongoing masterplan developments |

Clearly, Riyadh is moving faster in office demand and government-led infrastructure.

What Developers Are Building Right Now

Expect the following from current real estate projects:

- High-rise office towers linked to metro stops

- Luxury apartment buildings with full amenities

- Mixed-use zones combining retail, residence, and office

- Green, smart-city components such as energy efficiency and community infrastructure

Final Word: Riyadh Real Estate 2025 Offers Major Opportunity

To sum up, the Riyadh real estate 2025 story is compelling:

- Record-low vacancy and steep rent growth in offices

- Government-led HQ attraction and licensing growth

- Massive metro and infrastructure rollout

- Integrated living and lifestyle hubs under development

As a result, Riyadh is not just transforming—it’s positioning itself as a super hub of the future in the Middle East real estate arena.

How OPlus Realty Can Help You Capitalize

At OPlus Realty, we specialize in uncovering high-growth opportunities in emerging markets. If you’re considering Riyadh real estate 2025, we can help with:

- Market analysis and strategic portfolio insight

- Access to prime properties linked to infrastructure projects

- Support with due diligence, contracts, and investor guidance

Contact OPlus Realty today to discuss how Riyadh can elevate your real estate investments.