If you’re comparing Palm Jebel Ali vs Palm Jumeirah 2026, the real decision is not “which Palm is more famous.” It’s new vs established—and that affects everything: liveability, tenant demand, resale liquidity, and how long you’re willing to wait for a destination to mature.

Here’s the bottom line up front: Palm Jumeirah is the established, fully operational luxury island with a mature hospitality ecosystem and wide finished inventory. Palm Jebel Ali is the newer, larger Nakheel palm designed for future community planning and long-run growth, with an experience that will strengthen as phases, infrastructure, and lifestyle districts come online.

So “better” depends on your buyer type:

- If you want certainty + immediate use, Palm Jumeirah is usually the straightforward answer.

- If you want early entry + growth runway, Palm Jebel Ali is the higher-patience play.

The one difference that decides your choice fast

Palm Jumeirah = “live now” destination luxury.

Palm Jebel Ali = “be early” destination growth.

Palm Jumeirah already functions at full lifestyle speed (restaurants, hotels, promenades, marinas, branded living). Palm Jebel Ali is being delivered in stages—so the quality of life improves meaningfully over time as retail, leisure, and community services expand.

If your lifestyle needs are immediate (move-in, school routine, predictable short-term rental demand), the established island typically wins. If you’re comfortable holding through a development cycle, the emerging island becomes more attractive.

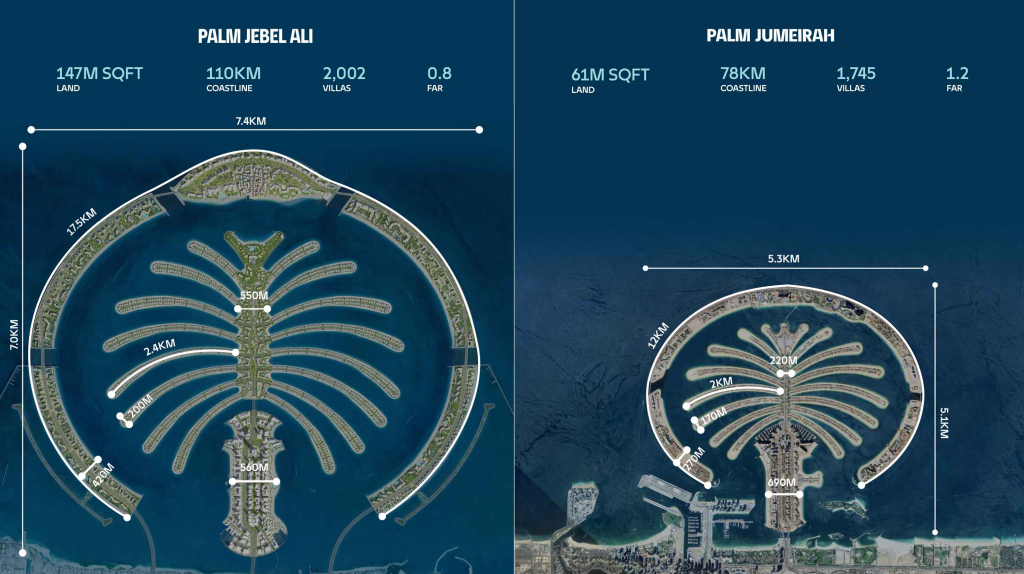

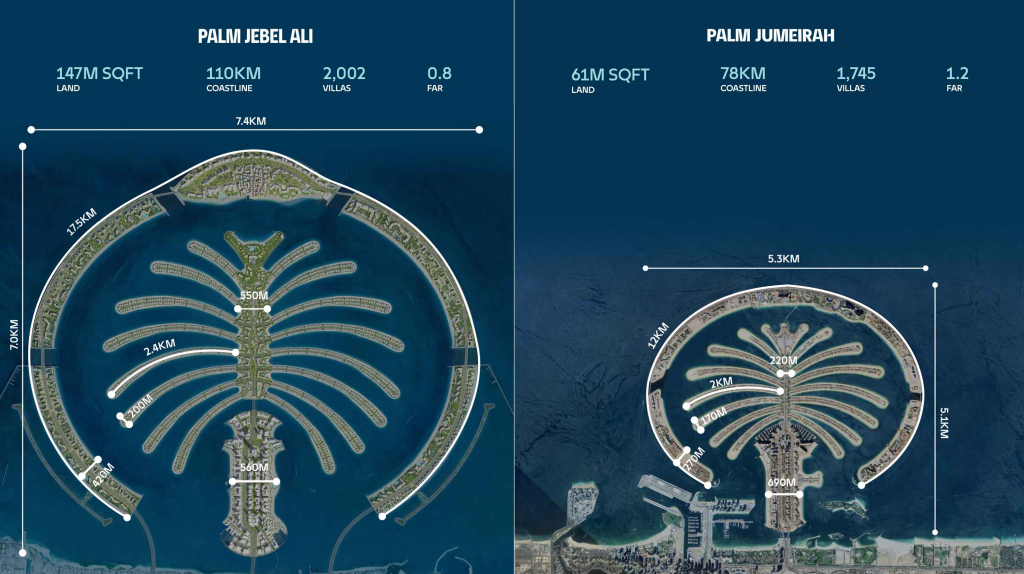

Size and masterplan: how much bigger is Palm Jebel Ali?

One of the biggest talking points in Palm Jebel Ali vs Palm Jumeirah is scale. Market guides and development summaries commonly describe Palm Jebel Ali as larger than Palm Jumeirah, with some references stating it’s around 1.5× bigger, while other market writeups use different scale comparisons depending on methodology.

Why that matters:

- More coastline and district variety potential

- More room for lower-intensity planning (quieter pockets over time)

- But also more reliance on sequencing (some zones feel “complete” earlier than others)

Practical takeaway: bigger can mean more breathing room—yet it can also mean your experience depends on which phase your property is in and what has been delivered around it.

Location and connectivity: central coast vs south growth corridor

Palm Jumeirah sits in Dubai’s established coastal corridor—close to major leisure zones and well-known business districts. That centrality supports:

- easier “Dubai weekend” access

- stronger short-stay and long-stay recognition

- broader tenant demand pools

Palm Jebel Ali sits further south, closer to the wider Jebel Ali / Dubai South growth direction, which may appeal to buyers who want:

- a less intense surrounding environment

- longer-run positioning as southern development expands

- newer masterplanning and infrastructure buildout

Infrastructure updates can be a key signal. In late 2025 reporting, Nakheel-linked updates referenced significant infrastructure works tied to Palm Jebel Ali timelines.

Lifestyle today: “ready now” vs “phased destination”

Palm Jumeirah lifestyle is defined by “operational convenience.” You’re buying into an ecosystem that already works—beaches, dining, hospitality, marinas, and mature residential demand.

Palm Jebel Ali is positioned as a newer coastal destination that aims to combine waterfront living with more space. Nakheel’s official development positioning emphasizes villas designed around beach views and premium finishes, signaling a luxury-lifestyle intent—but the full destination feel strengthens as supporting districts arrive.

If your lifestyle decision depends on what exists today, Palm Jumeirah has the advantage. If your lifestyle decision depends on what the destination is designed to become, Palm Jebel Ali can be a strong fit—if you accept the journey.

Property types and availability: what you can buy now

Palm Jumeirah offers a broad mix of finished stock: apartments along the trunk, high-spec towers, branded residences, and frond villas—so buyers get multiple entry points by budget and usage.

Palm Jebel Ali is more phase-led. Market tracking pages and project summaries commonly reference large planned totals—e.g., figures like ~1,700 villas and ~6,000 apartments in the wider plan—though what’s actively available depends on release windows, handover schedules, and phase progress.

Practical buyer lens:

- If you want choice + comparables + easier “buy now” execution, Palm Jumeirah wins.

- If you want newer product + early chapter entry, Palm Jebel Ali becomes interesting—especially for long-hold strategies.

Investors: stability profile vs growth profile

Most investors fall into two buckets:

Looking for the perfect property? Contact us now for a free consultation!

Contact us via WhatsApp1) Stability-focused investor (Palm Jumeirah bias)

If you prioritize proven demand, recognizable address strength, and more predictable resale/rental mechanics, Palm Jumeirah usually aligns better because it’s established and already supports multiple demand segments.

2) Growth-focused investor (Palm Jebel Ali bias)

If you can tolerate a longer horizon in exchange for potential upside as the destination matures, Palm Jebel Ali is often evaluated as a “development cycle” play—where value can shift as infrastructure, lifestyle districts, and destination branding expand.

Important: growth stories require patience—and disciplined selection (phase, location within the masterplan, and handover timing).

Families, end users, second-home buyers: what to prioritize

Families / end users

- Prioritize predictable services, a complete ecosystem, and minimal “waiting.”

- Palm Jumeirah generally fits better if you want move-in readiness and established daily convenience.

Second-home buyers

- Palm Jumeirah can be ideal for immediate lock-up-and-leave lifestyle.

- Palm Jebel Ali may fit second-home buyers who want a quieter future setting, but comfort with phased delivery is key.

Rule of thumb: choose the friction you can live with

- Palm Jumeirah friction: density + premium pricing

- Palm Jebel Ali friction: timing + ecosystem still developing

Ownership costs: service charges, maintenance, coastal exposure

Both are coastal environments, so plan for:

- exterior wear (humidity + salt air)

- higher-quality materials and ongoing upkeep expectations at luxury tiers

- service charge structures (especially for apartments/branded residences)

Whichever you choose, budget ownership costs realistically and verify documentation through RERA-aligned processes and official channels.

Palm Jebel Ali vs Palm Jumeirah comparison table

| Factor | Palm Jumeirah | Palm Jebel Ali |

|---|---|---|

| Status | Established, fully operational | Emerging, phase-led destination |

| Best for | Ready-now lifestyle + stability | Growth runway + early entry |

| Location feel | Central coastal corridor | South growth corridor positioning |

| Inventory | Broad finished mix | Availability tied to releases/handovers |

| Lifestyle | High energy, hospitality-led | More space-focused (as it matures) |

| Key risk | Paying premium for maturity | Timing + patience required |

Simple decision framework (3 steps)

- Define your goal: primary home, second home, or investment?

- Pick your timeline: move-in now vs hold through development cycle

- Match to friction: premium & density (Palm Jumeirah) vs timing & phased delivery (Palm Jebel Ali)

Then compare live inventory side-by-side and shortlist by what fits your weekly routine—not just your long-term plan.

FAQs About Palm Jebel Ali vs Palm Jumeirah

Yes—Palm Jebel Ali is widely described as larger. Some market references cite it as around 1.5× bigger than Palm Jumeirah, while other summaries use different scale methods. The key takeaway is that Palm Jebel Ali’s plan implies more coastline and district variety potential.

Palm Jumeirah is usually better for immediate lifestyle because it’s already a functioning destination with mature residential, hospitality, and leisure ecosystems. Palm Jebel Ali’s lifestyle depth grows as phases and supporting districts are delivered.

Palm Jebel Ali is commonly discussed as the longer-horizon option because its value story is linked to phased delivery and destination maturity over time. Palm Jumeirah is often viewed as the stability choice due to established demand.

Nakheel is the developer behind Palm Jebel Ali, and also the master developer of Palm Jumeirah.

Palm Jumeirah offers a wide range of finished options including apartments, high-end towers, branded residences, and villas (notably frond villas). This variety creates multiple entry points for end users, second-home buyers, and investors.

Market summaries commonly reference large planned totals including villas and apartments (e.g., figures like ~1,700 villas and ~6,000 apartments), but availability depends on phase launches and handover schedules.

Often yes in many segments because it’s established and has more comparable inventory and broader demand. Liquidity varies by micro-location and asset type, but “mature destination + more comps” typically supports smoother resale dynamics.

Conclusion

In the Palm Jebel Ali vs Palm Jumeirah 2026 comparison, the better choice comes down to timeline and temperament. Palm Jumeirah is the established option: mature lifestyle, proven destination demand, and broad finished inventory that supports end use and rentals today. Palm Jebel Ali is the emerging, larger-scale option: a longer runway, newer masterplanning, and a value story linked to phased delivery as infrastructure and lifestyle districts come online.

If you want certainty, immediate usability, and easier shortlisting, Palm Jumeirah is usually the practical answer. If you’re comfortable being early and holding through development cycles, Palm Jebel Ali may offer the growth profile you’re looking for.

Want a shortlist by budget and goal (end-user vs second home vs investment)?