Al Barsha real estate stands out in 2025 as one of Dubai’s most practical “live-and-invest” districts: central, infrastructure-rich, and flexible across budgets—without the volatility you often see in purely off-plan corridors. The bottom line: if you want easy access to Sheikh Zayed Road + Mall of the Emirates, reliable tenant demand, and a mix of apartments and large family villas, Al Barsha is still a high-confidence shortlist area.

Why this matters: in our viewing tours with OPlus Realty across Al Barsha 1 and Al Barsha South (Oct–Dec 2025), we consistently saw the same pattern—families prioritise school proximity and villa plots, while professionals and couples choose newer mid-rise buildings for layout efficiency and commute time. That mix reduces vacancy risk because demand is not dependent on one tenant segment.

This guide breaks down what Al Barsha looks like in real life—which sub-community matches your routine, what prices typically look like, and how to evaluate ROI versus lifestyle value.

Why Al Barsha remains a “central value” district in New Dubai

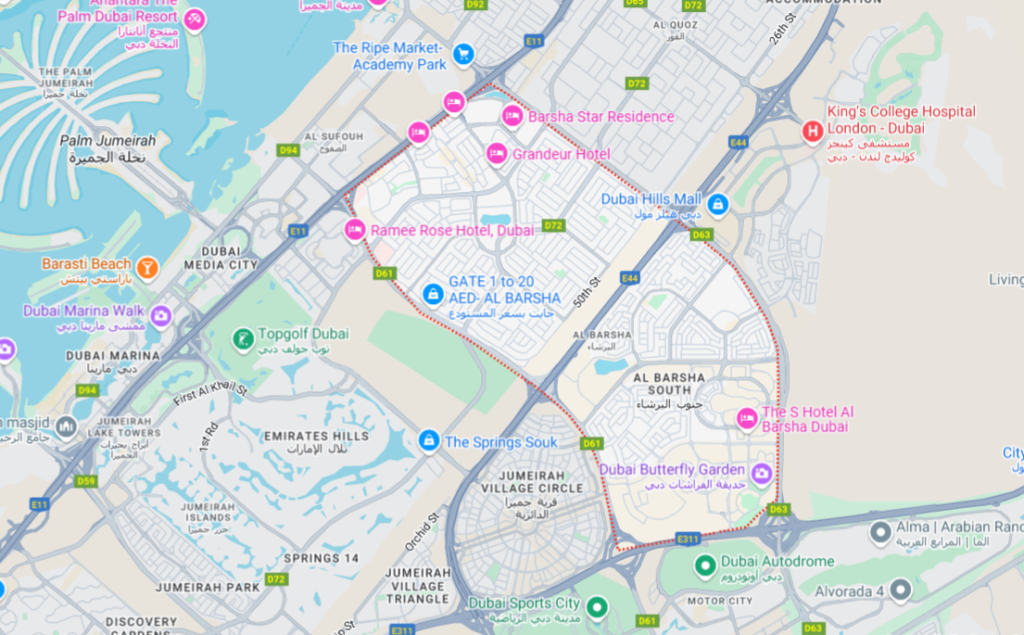

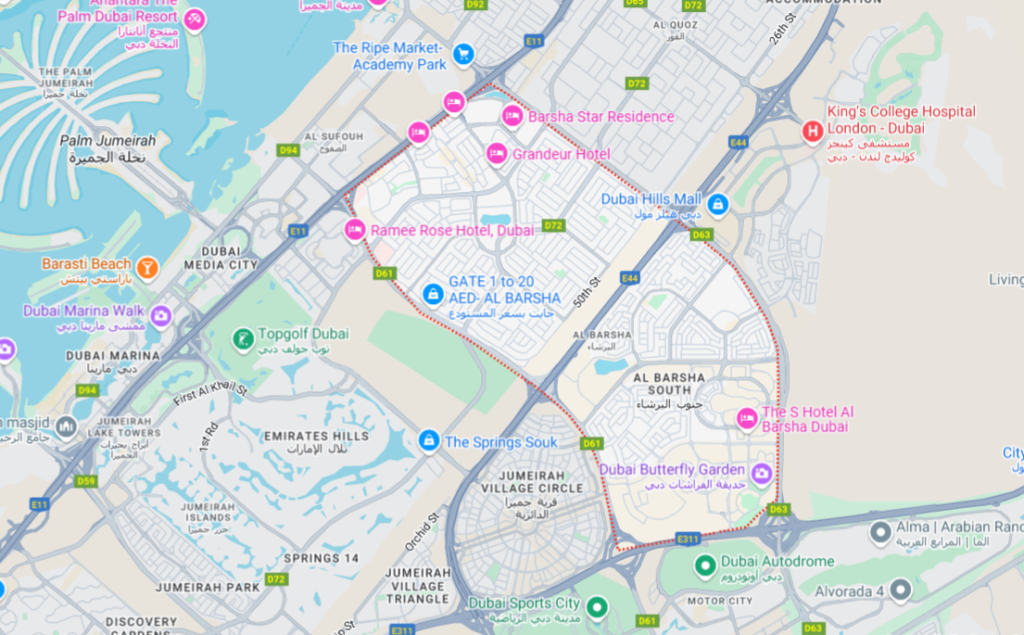

Al Barsha sits between major corridors (E11/E311/E44 access), so it behaves like a “connector” community: you can live near business districts without paying premium coastal pricing. The area is also anchored by Mall of the Emirates (and Ski Dubai), which sustains daily footfall and retail convenience year-round—helpful for residents and valuable for long-term rental demand.

From a buyer’s perspective, Al Barsha’s edge isn’t “hype”—it’s utility:

- practical commutes,

- established schools and hospitals,

- parks that residents actually use,

- and a wide property mix (apartments + large villas).

Al Barsha 1 vs Al Barsha 2/3 vs Al Barsha South: which fits you best?

Think of Al Barsha as three different lifestyles under one name:

Al Barsha 1 — convenience-first, urban, always active

If your routine is “metro + restaurants + quick errands,” Al Barsha 1 is typically the most convenient. It’s closer to the Mall of the Emirates zone and has a more commercial feel—useful for tenants who prioritise access and time savings.

Best for: professionals, frequent commuters, tenants who value walkable convenience.

Al Barsha 2 & 3 — quieter villa streets and family rhythm

These sub-communities skew more residential and villa-oriented. Streets feel calmer, plots are larger, and the “neighbourhood vibe” is stronger—especially for families who value privacy and space.

Best for: families, multi-generational living, buyers wanting plot-driven value.

Al Barsha South — newer inventory, modern layouts, investor-friendly

Al Barsha South often appeals to buyers who want newer building stock and cleaner community planning. It tends to attract younger resident profiles and value-driven tenants seeking modern finishes without paying prime waterfront premiums.

Best for: first-time buyers, investors targeting “modern unit demand,” long-term residents who like newer builds.

Property types & what you actually get (apartments vs villas)

Apartments (studios to 3BR) — practicality + rental liquidity

Apartments here usually compete on layout efficiency and building amenities (pool/gym/parking). In 2025, well-maintained buildings near key access routes tend to rent faster and face fewer negotiation rounds.

What to check during viewings (our on-ground checklist):

- parking allocation and visitor parking,

- AC type and average DEWA/chiller expectations,

- elevator/service quality,

- noise exposure (especially near busy roads),

- actual unit brightness (not listing photos).

Villas — space, privacy, and “family utility”

Al Barsha villas are often selected for space-first living (home offices, staff rooms, gardens, multi-car parking). They can command strong rents, but investor returns vary more because upkeep and plot costs are real.

Owner reality: landscaping, pool maintenance, and exterior wear are part of the true cost—budget them early.

2025 pricing snapshot: rents, sale prices & ROI

Below is a practical benchmark snapshot based on the figures you provided in your draft (use it as “publishing-day reference” and update quarterly from your listing data / market dashboards).

Average rent & sale benchmarks (Al Barsha)

| Property Type | Avg Rent (AED/yr) | Avg Sale Price (AED) | Typical ROI |

|---|---|---|---|

| Studio | 43,000 | 785,000 | 9.32% |

| 1BR Apartment | 64,000 | 1,081,000 | 6.65% |

| 2BR Apartment | 88,000 | 1,657,000 | 6.12% |

| 3BR Villa | 221,000 | 5,220,000 | 2.85% |

| 4BR Villa | 309,000 | 16,170,000 | 3.04% |

| 5BR Villa | 492,000 | 16,743,000 | 4.39% |

| 7BR Villa | 547,000 | 21,300,000 | 4.28% |

How to interpret this like an investor (not just a reader):

Looking for the perfect property? Contact us now for a free consultation!

Contact us via WhatsApp- Apartments tend to deliver cleaner ROI math and resale comparables (more liquidity).

- Villas can be “lifestyle assets” first—returns depend heavily on plot, condition, and tenant type.

Lifestyle that drives demand (the stuff tenants pay for)

Malls, daily convenience, and why “Mall of the Emirates” matters

Being near a major anchor like Mall of the Emirates supports a consistent lifestyle circuit—shopping, dining, and activities. That helps Al Barsha maintain steady occupancy because tenants choose it for routine efficiency, not trends.

Parks and outdoor routines

Al Barsha is known for parks and family-friendly outdoor spaces—especially Al Barsha Pond Park, which is a common daily routine destination (walking/jogging/family time).

Schools and nurseries

Families choose Al Barsha because school options are within workable drive times. Your article already lists strong examples—keep that section and add a “school-run commute time” angle (what time you actually leave, where traffic builds).

Hospitals and clinics (tenant confidence factor)

Healthcare access reduces friction for families and long-term renters. Keep your hospital list, and add: “nearest emergency route + typical drive time” as a practical lens.

Transport & access (metro names, roads, commute reality)

Al Barsha’s real advantage is that you can operate on roads + metro depending on your routine. Dubai Metro is the backbone for many residents city-wide.

Metro note you should publish correctly (naming matters)

RTA’s station naming changes happen via official agreements. RTA previously announced naming-rights updates for stations (official news pages).

Publishing tip: mention “nearest stations” without over-committing to a single name if you’re not updating weekly; use “formerly known as…” where relevant.

Roads that matter

Highlight practical arteries: E11 Sheikh Zayed Road, E311 Sheikh Mohammed Bin Zayed Road, E44 Al Khail Road, plus Hessa Street for cross-city movement.

Investor lens (how to choose a unit that rents faster)

If your goal is steady occupancy, choose based on tenant behaviour, not just unit specs.

What tends to rent faster in Al Barsha

- Efficient 1BR layouts near core access routes (value-to-rent sweet spot)

- Buildings with parking clarity (tenant friction-killer)

- Units with balanced daylight + quiet orientation (less churn)

Simple investment framework (OPlus Realty)

- If you want yield stability: focus on studios/1BR/2BR with clean comparables.

- If you want family tenancy: look at villas or large apartments near schools/parks.

- If you want resale flexibility: pick buildings with consistent transaction history.

FAQ — Al Barsha real estate 2025

Yes—Al Barsha real estate can be investment-friendly because demand comes from both families and professionals. Apartments often deliver clearer comparables and steadier yields, while villas behave more like lifestyle assets with higher upkeep. Validate ROI using current rent, service charges, and vacancy assumptions before buying.

Foreign nationals can buy in Dubai in designated ownership zones and specific project structures. For Al Barsha, eligibility depends on the project and title structure. A licensed broker can confirm whether a building is freehold/leasehold and guide you through DLD transfer, fees, and compliance.

As a benchmark from the provided dataset, studios average around AED 43k/year, 1BR around AED 64k, and 2BR around AED 88k. Actual rent depends on exact building quality, parking, view/noise, and whether the unit is furnished.

The provided figures indicate an overall average ROI around 6.89%, with studios reaching ~9.32% and 1BR around ~6.65%. ROI varies by service charges, maintenance, and achievable rent rather than headline price alone.

It works for both. Al Barsha 2/3 tends to fit families who want villa streets and calmer routines, while Al Barsha 1 and Al Barsha South often suit professionals who prioritise convenience, newer buildings, and commute efficiency.

Mall of the Emirates is the anchor landmark, and Al Barsha Pond Park is a major outdoor routine spot for residents.

Conclusion

Al Barsha’s strength in 2025 is that it blends central Dubai access with a lived-in, infrastructure-rich environment—making it attractive to end users and investors for different reasons. If you want predictable routines and family utility, Al Barsha 2/3 (villa streets and calmer rhythm) often feels like the better lifestyle fit. If you want convenience-first living with strong leasing demand, Al Barsha 1 and parts of Al Barsha South can offer cleaner rental liquidity—especially for studios and 1BR/2BR units that match the most common tenant profiles.

The smartest approach is to stop searching for “the best area” and instead choose the right micro-location + right building. Two listings a few minutes apart can perform very differently depending on parking, noise, maintenance quality, and layout efficiency.

If you want a precise shortlist based on your budget and goals, we can map 6–10 options and compare them with real numbers.

Explore Al Barsha listings or schedule a viewing with OPlus Realty today.