Dubai has firmly established itself as a premier economic hub, attracting global investment with its vibrant, high-growth financial markets. If you’re looking to capitalize on this dynamic environment—whether you’re a local resident or an international investor—your first, non-negotiable step is obtaining a Dubai Financial Market Investor Number (NIN).

This unique identifier is your passport to trading on the Dubai Financial Market (DFM) and Nasdaq Dubai securities. Crucially, the process for how to apply DFM Investor Number online has been streamlined for speed and convenience, reflecting the UAE’s focus on digital services.

Therefore, this comprehensive 2025 guide breaks down everything you need to know. We’ll cover the definition of the NIN, provide clear, step-by-step instructions for the official DFM App and E-Services, detail all required documentation, and answer common questions about fees and processing times. Get ready to secure your trading eligibility and unlock the potential of the Dubai market.

What is a DFM Investor Number (NIN) and Why Do You Need It?

Defining the Investor Number

The DFM Investor Number (NIN), often referred to as the National Investor Number, functions as your essential membership ID within the Dubai capital market structure. It’s issued by the Dubai Central Securities Depository (CSD), which is the regulatory arm of the DFM responsible for registering all market participants.

In essence, this number ensures the accurate identification and settlement of all your transactions. It guarantees that the shares you buy and sell are correctly logged under your name and that any corresponding dividends are securely delivered to your designated bank account.

The Key to Trading Eligibility

Without a valid DFM NIN, you simply cannot execute trades. The NIN is a mandatory prerequisite for several key activities. Specifically, it allows you to:

- Trade: Buy and sell shares listed on both the Dubai Financial Market (DFM) and Nasdaq Dubai.

- Receive Dividends: Ensure cash dividends from your investments are deposited directly and securely.

- Participate in IPOs: Subscribe to shares during Initial Public Offerings (IPOs) launched on the DFM.

- Manage Assets: Control and monitor your portfolio across all licensed brokerage firms.

Therefore, securing your Dubai Financial Market investor number is the foundational step before you even start researching stocks or selecting a brokerage firm.

The Modern Process: How to Apply DFM Investor Number Online

The DFM has invested heavily in digital infrastructure, recognizing that speed and ease of use are paramount for attracting international capital. Consequently, the best and fastest way to get your NIN is by utilizing their robust online channels. The application process usually takes only one working day once submitted correctly.

Streamlined Application via the Official DFM App

The DFM mobile application provides the most intuitive and user-friendly experience for your NIN application. It is specifically designed to handle the required documentation scans and verification steps right from your smartphone, ensuring your trading eligibility is secured quickly.

Follow these simple steps to apply DFM Investor Number online using the app (available on both the App Store and Google Play Store):

- Download and Log In/Sign Up: Begin by downloading the official DFM App. Sign up using your email or mobile number, or log in if you have existing credentials.

- Document Scanning: The app will prompt you to capture clear scans or photos of your identification documents. This includes your valid Emirates ID (for residents) or your Passport (for non-residents).

- Facial Verification: You will be required to take a live selfie. This biometric step verifies your identity against your official documents, significantly enhancing security and compliance.

- Enter Personal Details: Input your current residential address and contact information accurately.

- Signature Submission: Digitally capture or upload your signature onto the required form within the app.

- Select Dividend Method: Choose your preferred method for receiving cash dividends. This is usually linked directly to a bank account.

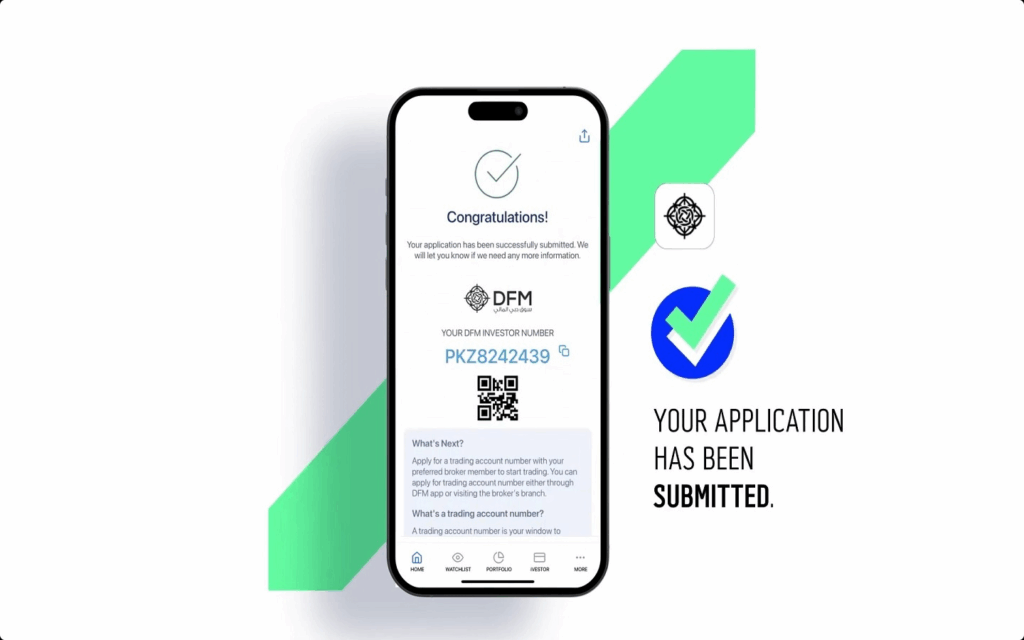

Finally, once successfully submitted, you will receive your unique Investor Number instantly via SMS notification to your registered mobile number, concluding the digital application process.

Using DFM E-Services and UAE Pass

If you prefer using a desktop interface, the DFM’s official website E-Services platform offers an equally efficient application route. This method relies on the UAE Pass—the national digital identity solution—to streamline verification.

Here is the straightforward process for the DFM E-Services application:

- Log In via UAE Pass: Access the DFM e-Services portal and choose to log in using your UAE Pass. This instantly verifies your identity and extracts most of your personal data from official records.

- Navigate to eFORMS: Once logged in, navigate to the dedicated eFORMS tab on the dashboard.

- Complete the Request Form: Locate and fill in the Investor Number Request form. Since the UAE Pass has pre-filled much of the data, this step is often quicker.

- Attach Documents and Sign: Attach any remaining required documents (if prompted) and digitally add your signature.

Subsequently, just as with the app, the successful submission will trigger an SMS containing your new DFM NIN.

Traditional and Specialized NIN Application Methods

While the digital routes are recommended for speed, the DFM maintains robust options for individuals who require in-person assistance, or those applying on behalf of others. Indeed, these alternatives ensure accessibility for every type of investor.

In-Person Registration at Dubai CSD Investor Affairs

If you prefer face-to-face assistance, or if the applicant is a minor or requires a legal representative, the Investor Affairs desk at the Dubai Central Securities Depository (CSD) is the proper venue. Here, the staff can guide you through the submission and signing process seamlessly.

The process for in-person registration involves:

- Document Submission: Present all your required physical or digital documents to the CSD staff.

- Digital Signature: The applicant can sign the Investor Number Request form digitally right there at the desk.

Ultimately, the DFM National Investor Number will still be delivered electronically to the registered mobile number via SMS.

Want to know more about available properties? Our team is ready to answer your questions. Contact us now!

Contact us via WhatsApp

Registering Through a Licensed Trading Member (Broker)

Many investors prefer to establish their brokerage relationship immediately. Therefore, you have the option to submit your NIN application directly through a licensed trading member of the Dubai Financial Market.

These brokerage firms are authorized to assist with the entire registration process, often integrating the NIN application with your new trading account setup. You can find a complete list of licensed trading members via the DFM Broker Directory on the official website. This approach is highly efficient if you have already chosen your specific brokerage firm.

Critical Documentation Checklist for Your NIN Application

A correct and complete document submission is the most critical factor in guaranteeing a fast DFM NIN application turnaround. Therefore, take care to prepare all the necessary copies and authentications based on your investor profile.

Standard Requirements for Individuals (Residents and Non-Residents)

Whether you choose to apply DFM Investor Number online or in person, all applicants must submit the following:

- The completed and signed Investor Number Request form.

- A clear copy of your valid Emirates National ID (mandatory for UAE residents).

- A copy of your valid passport (mandatory for non-residents).

Furthermore, if you are a non-UAE resident, ensuring the clarity of your passport copy is paramount to avoid delays.

Special Documentation for Minors

Minors (individuals under 18 years of age) are allowed to invest in the DFM, provided they apply under the guardianship of an adult. However, specific guardianship documents are required to confirm eligibility.

- Guardian’s Signature: The signature of the Father (as the default Guardian) is required on the request form.

- Guardian’s ID: A copy of the guardian’s Emirates ID (for UAE residents) or passport (for non-residents).

- Alternative Guardianship: If the guardian is someone other than the father, you must provide a true copy of the duly authenticated guardianship order issued by a court or Notary Public. Consequently, any guardianship order issued outside the UAE must be certified by the UAE Embassy in the issuing country and the UAE Ministry of Foreign Affairs.

Applying via a Representative (Power of Attorney)

If you are unable to apply in person or online, you can use a representative via a legally recognized Power of Attorney (POA). This is a common arrangement for international investors.

In this case, the submission must include:

- A copy of the legally authenticated Power of Attorney issued by the court or Notary Public.

- A copy of the representative’s Emirates National ID.

Moreover, if the POA originates from outside the UAE, it must be fully attested by the official authorities and the UAE Embassy in the foreign country, followed by certification from the UAE Ministry of Foreign Affairs. This attestation chain is vital for legal recognition within the DFM system.

Special Cases: Marsoom Holders

Individuals holding a valid Marsoom (a specific type of decree or grant) must provide a valid copy of the Marsoom addressed specifically to the Dubai CSD. This document supersedes some of the standard identity requirements.

Post-Registration: Opening Your Brokerage Account and Tracking Your NIN

Once you receive the SMS confirming your DFM Investor Number (NIN), you’ve secured your trading eligibility. But what comes next?

Selecting and Opening a Trading Account

The NIN is a registration number, but it is not a trading account. Therefore, your immediate next step is to choose a licensed brokerage firm and open a dedicated trading account with them. This account is where you will deposit funds, place your buy and sell orders, and hold your securities.

The DFM has a directory of licensed brokers on its website, providing a transparent list to help you make an informed choice. Essentially, the broker acts as your intermediary, executing your trades on the DFM.

What if I Lose or Forget My NIN?

Losing or forgetting your DFM NIN is a common issue, and the process to retrieve it is quick and straightforward. You have three easy options:

- Call the DFM Hotline: The dedicated investor number is +971-4-305-5555. The automated system will guide you through the self-explanatory steps to retrieve your NIN.

- DFM App Request: You can submit a retrieval request directly through the DFM App.

- In-Person Visit: Visit the DFM Trading Floor or a Dubai CSD office for immediate in-person assistance.

Is There a Fee to Register My NIN?

No, there are no charges for registration. The DFM provides the service of securing your Dubai Financial Market Investor Number free of cost to encourage broad participation in the market.

Conclusion: Trading in Dubai, Transparently and Securely

The process to apply DFM Investor Number online is a testament to the sophistication and transparency of the Dubai Financial Market. Whether you are expanding an existing portfolio or are a first-time investor, acquiring the NIN is your crucial first step towards financial opportunity in the UAE.

The DFM ensures that all processes—from the initial NIN application to the final receipt of dividends—are transparent, secure, and fully compliant with international best practices. By utilizing the DFM App or E-Services, you can efficiently transition from an interested applicant to a fully registered market participant, usually within a single working day.

Have you completed your DFM NIN application yet? If you have any questions about selecting the right brokerage firm or understanding dividend mechanisms, share your thoughts below, and let’s keep the conversation going!